Contents:

While gross sales vs. net sales are terms that may be more familiar to accountants and investors, knowing what these mean as a salesperson or sales manager is still vital. It can give you a strong indicator of business performance and help identify any potential issues before they become serious problems. If you find your business offering allowances on a regular basis, something needs to change. Continually offering allowances not only impacts your revenue, but it can make it harder to accurately forecast your future sales. For sales teams, the biggest concern is if products are returned because they don’t meet the buyer’s requirements.

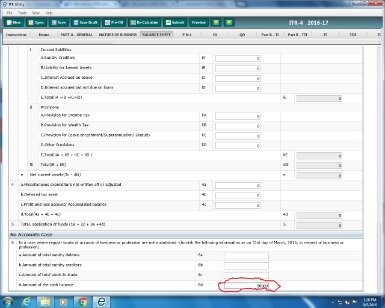

Net sales is the result of gross sales minus returns, allowances, and discounts. It is best to report gross sales, followed by all the discounts that were given on sales and then listing the net sales number. Showing your sales this way clearly show when there is a change in sales deductions, overly large marketing discounts and other changes to the quality of sales. Financial statement notes should clarify as to any reasoning behind large discounts from sales.

In most cases, you’ll record the gross sales first, followed by discounts and deductions. After you’ve registered net sales, you’ll need to generate an income statement, adding your net sales to your firm’s other revenue streams. Gross sales is the total amount of products and services sold during a period of time. You can think of gross sales as the total dollar amount of invoices that you sent to clients. Fees for production, shipping, and storage, as well as any discounts, allowances, and returns, can all potentially contribute toward this cost.

Once you have gathered all of the necessary information, you can then use it to calculate your business’s net sales. Every revenue-affecting change in your business needs to be accounted for. For example, if you alter a pricing page, underlying spreadsheets will have to be changed to account for this. Discounts, refunds, new pricing, additional revenue, and enterprise tiers can all complicate the amount of data that needs to be reconciled at the end of the year.

As a result, the sales taxes included in a company’s sales invoices are recorded in a current liability account such as Sales Taxes Payable. When the company remits the sales taxes to the state or local government, the balance in Sales Taxes Payable is reduced. Any unremitted balance in Sales Taxes Payable is reported in the current liability section of the company’s balance sheet.

Several of your customers took advantage of the sales discount and paid their invoices early. Your sales returns totaled $10,000 and your sales allowances totaled $23,000. From your gross income of $200,000, subtract $3,000, $10,000 and $23,000 to arrive at your net income of $164,000.

This type of account is referred to as a contra-account, which is an account used to reduce the value of another related account. For companies using accrual accounting, they are booked when a transaction takes place. For companies using cash accounting they are booked when cash is received. Some companies may not have any costs that will require a net sales calculation but many companies do. Sales returns, allowances, and discounts are the three main costs that can affect net sales.

Use the OKR framework to set goals that empower your team to exceed revenue targets. Take inspiration from 10 powerful examples of digital marketing OKRs in action. Pipedrive’s revenue management software allows sales teams to track revenue, sales and invoices – all from one location.

Company A has gross sales of $500,000 and net sales worth $350,000. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision.

2023 Readers’ Choice Awards – The Readers Have Voted!.

Posted: Mon, 17 Apr 2023 18:39:15 GMT [source]

For example, if your net sales figures are considerably lower than your competitors, there’s cause for investigation. You may need to adjust your pricing, amend your product features, or upgrade your product quality to gain a competitive advantage. This is where reviewing net sales alongside gross sales comes in handy. For example, imagine that your customer ordered $3,000 worth of your product, but they receive the wrong color. While the product still functions correctly, the customer might ask for compensation given that the delivered goods weren’t as described. To keep the customer happy, your company might offer a partial refund of $300.

Net sales are the total revenue generated by the company, excluding any sales returns, allowances, and discounts. Net sales is equal to gross sales minus sales returns, allowances and discounts. Net sales is often used by investors, lenders, and other financial professionals to assess the viability of a business.

A seller would need to debit a sales returns and allowances account and credit an asset account. This journal entry carries over to the income statement as a reduction in revenue. A boutique clothing store made $5,000 in total sales last month – this is the gross sales revenue for the period. However, some of the items sold were discounted by 50% because they were left over from last season.

This gives a retained earnings some wiggle room for special promotions and sales. For a car company, they may have allowances for a questionable part that has the potential of being recalled. It basically allows the company to preemptively account for defective merchandise.

Virtu Announces First Quarter 2023 Results.

Posted: Thu, 20 Apr 2023 11:00:16 GMT [source]

So, if you sold 200 units in Q1 and the unit price is $40, your gross sales revenue is $8,000 for that quarter. Net Revenue (or “net sales”) refers to a company’s gross revenue after adjusting for returns by customers and any incentive discounts. If you don’t properly account for these adjustments, your gross profit will be overstated as will your total revenue number. This simple omission can cause incorrect financial statements, which leads to inaccurate financial ratios and misstated profit levels for your business.

For example, if you have sales of $100,000 and returns and allowances of $25,000, your net sales amount is $75,000. Net Sales is the sales or revenue that your business has earned after all sales adjustments have been taken. Net sales is reported on your income statement, and should always be calculated for any business that sells products.

As such, business owners need to understand how to calculate their net sales. To do this, you’ll need to gather a few pieces of information, such as gross sales, discounts, returns, and allowances. For instance, calculating your company’s net sales can help you to ascertain its gross profit margin.

A business might earn $150,000 in sales, but they could end up losing $25,000 of that money due to faulty products or incomplete transactions. To account for this, you can calculate net sales by subtracting returns and allowances from gross profit. Returns, of course, means the value of any products that were returned by customers. Allowances, in this case, are allowances for discounts on products that are sold.

This may raise potential concerns about your short-term profitability. A company’s total sales is an important figure, but it doesn’t tell the whole story. The gross sales are the value of all the products a company sold over a particular period.

However, your sales allowances and deductions should not include cost of goods sold, which is subtracted separately from your net sales total. Companies calculate the net sales and compare them to the industry average. If the difference between gross sales and net sales is higher than the industry average, it usually indicates that the company is offering higher discount rates compared to competitors. It can also indicate that the company has excessive sales returns compared to competitors, which signals an issue in the manufacturing process or quality of the good. Discounts are a common strategy used by sellers that work on an invoicing basis. For instance, the company might offer a 10% discount if the customer pays the total amount in less than one month.

This number represents her gross sales, but Michelle knows she won’t actually book the entire $5,000. If a company’s income statement only has a single line item for revenues that is labeled “sales,” it is usually assumed that the figure refers to net sales. Calculate his discount by multiplying $10,000 by 2 percent, which is $200. Gross sales and net sales are, at times, confused and assumed to be similar.

It can also help you to identify which products and services are most profitable and which ones are not. This information can then be used to focus on the more profitable products and services and to make changes to the business strategy. Net sales refers to the amount of money taken in by a business after adjusting for discounts, returns, and other sales-related adjustments. A business’s net sales is a useful indicator of its overall performance, as it shows how much money the business is actually earning from its sales activities.

For instance, if the restaurant manager complains to the company that one table was damaged due to transportation and agrees to have a partial refund of $30. The table manufacturer will need to debit the allowances account by $30. Net sales is usually the total amount of revenue reported by a company on its income statement, which means that all forms of sales and related deductions are combined into one line item. Gross sales should be shown in a separate line item than net sales as there can be substantial deductions from gross sales.

Furthermore, net sales provide a good indication of your business performance in general and can help you identify areas for improvement. By tracking net sales, you can ensure that your business is on the right track and that you are making the most of your sales opportunities. Gross revenue concerns all income from a sale, with no consideration for any expenditures from any source. If a retailer sells the latest in a new line of sneakers for $100, the gross revenue would be $100. Revenue is the most fundamental metric for any company, and yet it is seldom understood perfectly.