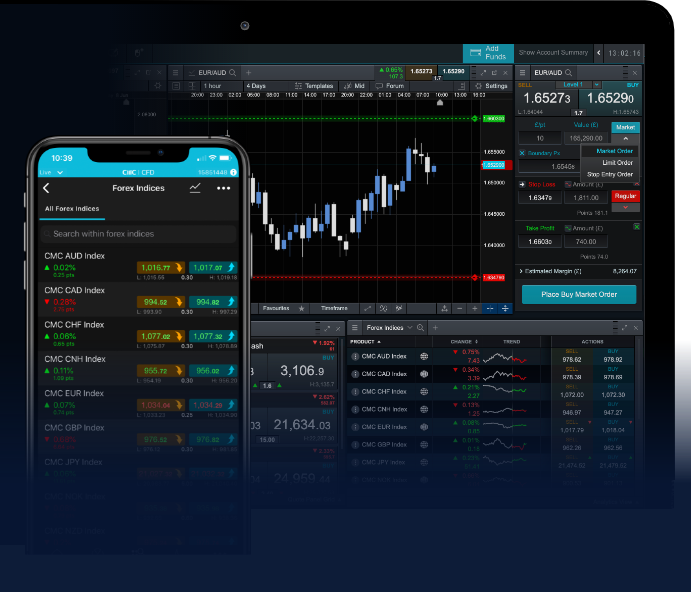

The foreign exchange market, commonly known as Forex or FX, is the largest and most liquid financial market in the world. It facilitates the exchange of currencies and operates 24 hours a day, five days a week. Understanding the dynamics of forex trading is crucial for anyone looking to capitalize on the fluctuation of currency values. In this article, we will explore the fundamental principles, trading strategies, and psychological aspects of forex trading. For more information, you can visit forex trading foreign exchange market https://trading-asia.com/.

Forex trading involves buying one currency while simultaneously selling another. This trading occurs in pairs, such as EUR/USD or GBP/JPY, where the first currency is referred to as the base currency and the second as the quote currency. The value of a forex pair reflects how much of the quote currency is needed to purchase one unit of the base currency.

Several factors make forex trading appealing:

In the forex market, currencies are traded in pairs. Here are the key types:

Successful forex trading requires a solid trading strategy. Here are some popular approaches:

Scalping involves making numerous trades throughout the day to capture small price movements. Scalpers typically hold positions for a few seconds to a few minutes.

Day trading entails opening and closing positions within the same trading day. Day traders aim to capitalize on short-term price fluctuations and avoid overnight risk.

Swing traders look to profit from price swings in the market, holding positions for several days or even weeks. This strategy requires a good understanding of technical analysis.

Position trading is a long-term strategy where traders hold onto their positions for months or years, relying on fundamental analysis to guide their decisions.

To succeed in forex trading, it’s essential to incorporate both technical and fundamental analysis:

This involves studying historical price data and using charts to forecast future price movements. Key indicators include moving averages, relative strength index (RSI), and bollinger bands.

Fundamental analysis examines economic indicators, news events, and geopolitical events that can affect currency values. Understanding economic reports, interest rate decisions, and political stability is crucial for making informed trading decisions.

Trading psychology plays a significant role in a trader’s success. Emotions like fear and greed can lead to rash decisions, which is why developing a disciplined mindset is essential. Here are some key psychological tips:

Effective risk management is critical to long-term success in forex trading. Consider these techniques:

Forex trading is a rewarding yet challenging venture that requires a deep understanding of the market, solid research, and a disciplined trading strategy. By mastering the fundamentals of currency pairs, implementing effective trading strategies, managing risk, and maintaining a strong psychological framework, traders can navigate the complexities of the foreign exchange market with confidence. Start small, practice with a demo account, and gradually build your skills before committing significant capital to live trades.